The Lilac Review: Accelerating inclusive investment processes is essential to unlock UK’s growth

By Chloe Schendel-Wilson, Co-Founder and Director

Supporting disabled founders and businesses delivers value for everyone.

Universal design, where products created for disabled people go on to have an outsized impact, is all around us. Automatic doors introduced in the 1970s for hands-free access benefit everyone, while Velcro and electric toothbrushes, originally designed for those with limited dexterity, are now in everyday use.

Workplace innovations such as ergonomic furniture and standing desks improve productivity for all, not just those with musculoskeletal conditions. Equally, assistive software and speech to text now helps drive advances in AI, emailing and communications for everyone.

At the heart of this, is a clear need to support disabled entrepreneurship, to overcome barriers and unlock inclusive-led economic growth. We therefore reflect on The Lilac Review, whose final report out last week, outlined the challenges facing disabled businesses and how to overcome them.

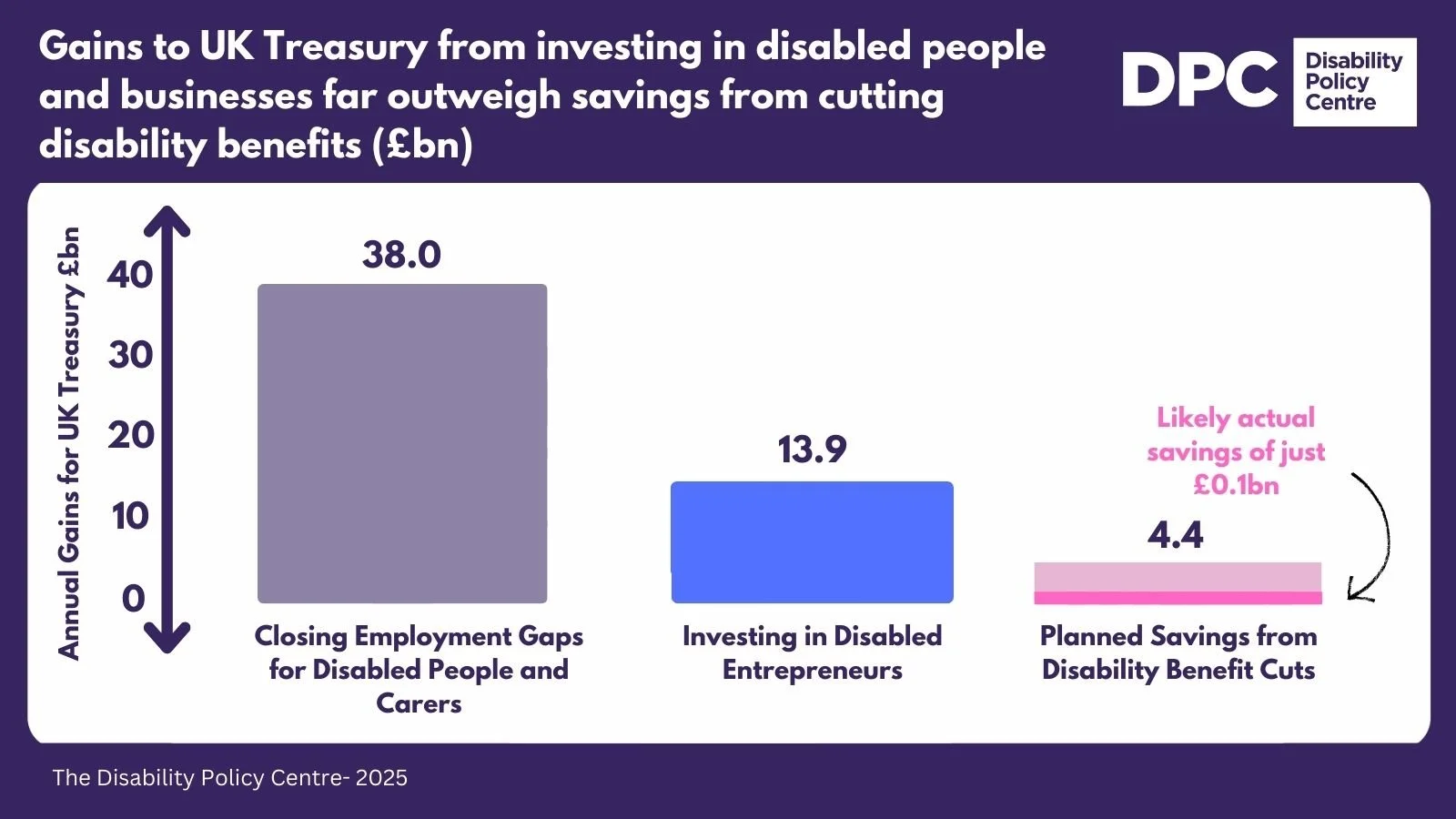

Investing in disabled people and their businesses will deliver over three times as much for the UK Treasury than cutting support or benefits ever could

The Lilac Review has previously noted that whilst a quarter of the UK’s 5.5 million small and medium sized enterprise (SME) owners had a long-term health condition or disability, they only accounted for less than 9% of business turnover. The Review suggests consequentially, “that improving opportunity for Disabled founders could unlock an additional £230 billion for the UK economy”.

We estimate that if disabled-led SMEs matched the turnover levels of their non-disabled counterparts, this could yield nearly £14bn annually in additional tax revenues for the UK Treasury.

The ONS (2024) reports a net rate of return of 8.8% for private non-financial corporations, which we proxy as the average net profit margin for SMEs. Applying the 19% Corporation Tax rate (Small Profits Rate) to the turnover uplift would generate approximately £3.8bn in additional tax revenue each year from corporate tax receipts alone.

Greater turnover would also support more jobs, particularly for disabled people. Based on the Department for Business and Trade’s 2024 Business Population Estimates, assuming an average turnover per employee of £166K, this uplift could support an additional 1.3 million roles. Applying the latest Employer and Employee National Insurance rates and the average UK salary, this would generate an estimated £10.1bn in NI contributions annually, or £13.9bn in total.[1]

We note in Figure 1 that this increase in additional tax revenue is over three times the amount the Government has proposed it will save from cuts to Personal Independence Payment (PIP) and changes to the health-related top up of Universal Credit, and around 100 times greater than the savings likely to materialise in practice. It is also equivalent to a quarter of the £38 billion we have previously estimated could be gained by closing employment gaps for disabled people and carers.

Figure 1:

Delivering impact for disabled entrepreneurs requires tackling the barriers to scale and finance

The Lilac Review’s final report finds that amongst disabled entrepreneurs, 56% find that growing sales and scaling operations as their top challenge, with 47% reporting difficulties in accessing finance and funding.

In 2022, together with Clu, we co-founded #Access2Funding to address these systemic barriers. Our initial report (click here to read more) revealed that disabled founders were 400 times more likely to face obstacles in accessing capital. 84% of respondents in our initial report reported that they lacked equal access to the same opportunities and resources as non-disabled founders.

The Lilac Review also highlights that over a third (35%) of disabled entrepreneurs report a lack of accessibility accommodations in existing support programmes. More than half (51%) identified the need for tailored support as very important, echoing the finding our own initial report and work.

Policy must create an accessible capital raising framework tailored to the needs of disabled businesses, alongside a business-led approach for Access to Work.

The Lilac Review recommends that, alongside stronger commitments from financial institutions, investment products must embed accessibility into their processes and offer more flexible repayment terms or structures to improve uptake by disabled founders. It also calls for greater government involvement, reforms to procurement processes, expanded networking and mentoring opportunities, and the scaling of successful pilots, such as those delivered through Small Business Britain and Lloyds, to support inclusive entrepreneurship at scale.

We recognise that creating a more inclusive capital raising framework will be essential, but that they must also occur alongside changes that remove unnecessary layers of bureaucracy. Currently, we have found that many self-employed disabled people often struggle to receive Access to Work support effectively, as DWP assessors are not adequately equipped to understand or support them in their role as business owners, rather than as employees.

[1] We exclude the role of the Employment Allowance (EA) on the basis that this uplift relates to additional turnover within existing businesses. However, this may represent a conservative estimate, as also excludes other fiscal effects. Of NI contributions, Employer NI relates to £6.8bn and Employee NI relates to £3.3bn pa.

References

Department for Business and Trade (2024). Business Population Estimates for the UK and Regions 2024. Retrieved from: https://www.gov.uk/government/statistics/business-population-estimates-2024

HM Revenue & Customs (2025). Employer National Insurance Rates and Thresholds for 2025 to 2026. Retrieved from: https://www.gov.uk/national-insurance-rates-letters

The Lilac Review (2024). Final Report on Disabled Entrepreneurs and Inclusive Investment. Retrieved from: https://www.lilacreview.com

Office for National Statistics (2024). Profitability of UK Companies, April to June 2024. Retrieved from: https://www.ons.gov.uk

Office for National Statistics (2025). Average Weekly Earnings in Great Britain: May 2025. Retrieved from: https://www.ons.gov.uk

The Lilac Review (2024). Final Report on Disabled Entrepreneurs and Inclusive Investment. Retrieved from: https://www.lilacreview.com